Prominent German sim racing peripheral manufacturer Fanatec and its parent company Endor AG have today (31st May) published their Q1 2024 earnings report.

This follows an internal power struggle, with founder and (now former) CEO Thomas Jackermeier ousted from his post in March, purportedly as a condition of bank loan standstill agreements. Andres Ruff was appointed as his replacement.

Meanwhile, Endor AG issued statements stating that it was close to insolvency and that restructuring was underway in accordance (somewhat controversially) with the German Act of Stabilisation and Restructuring of Companies (StaRUG).

StaRUG is a legal blueprint that allows for financial restructuring outside of insolvency.

Earlier this month, the parent company announced that it was in discussions with American gaming PC and accessory manufacturer Corsair for the purchase of the Landshut-based operation.

On 15th May, Endor issued a statement that claimed Corsair would “provide interim financing.”

Q1 2024 results head in the right direction

Fanatec and Endor posted earnings before interest, taxes, depreciation and amortization (EBITDA) of €1.2 million and revenues of €30.5 million in the first quarter of this year. This is compared to a negative EBITDA of -€1.9 million in Q1 2023, and a 72.3% increase in revenue when compared to 12 months ago.

It follows a comparatively dismal 12 months. In Q3 2023, it posted a negative EBITDA of -€3.5 million, in Q2 2023 -€3.1 million and Q1 2023 -€1.9 million. In the year 2022, it reported EBITDA of €14.1 million. Its full-year 2023 financials, and thus Q4 2023, remain unpublished.

Despite the increased figures, the company remained cautious, stating that the dramatic increase in revenue this year compared to the same period last year was in part due to “the first quarter of 2023 [being] significantly limited due to the chip shortages and the resulting supply chain problems in the previous year’s quarter.”

“Additionally, around EUR 5.0 million of the revenue for the first three months of 2024 were due to a sales shift from the fourth quarter of 2023 to the first quarter of 2024, thus attributable to purchase orders from the previous year.”

The numbers follow accusations of mishandled Black Friday website orders, alleged slow customer support and a significant delay to Clubsport DD+ wheel base deliveries.

Possible fightback

While the current Endor board tries to push through the Corsair sale – a company that also owns the Elgato and Scuf Gaming brands – factions with Fanatec seemingly try to resist.

Earlier in May, a group going by the name of “Investorengruppe Jackermeier” published a press release claiming that it had submitted a financing offer totalling €48.439 million to assist Endor.

“The group is demanding that the CEO and CFO of Endor AG are to be removed from office and that two members of the Supervisory Board are to resign,” read the statement.

Ahead of then, in late April, Jackermeier alleged via Impact Communication that investment conglomerate Birkenstein Capital was planning a takeover of Endor AG:

“I myself will probably be significantly diluted by this package, but the company must now be saved. Interest in the capital increase is very high due to the low subscription price, especially since the risk of insolvency is averted with a successful capital increase,” said Jackermeier.

There are claimed links between current Endor Chief Financial Officer Matthias Kosch (appointed November 2023) and senior representatives at Birkenstein – although Endor AG has only publicly stated that it is negotiating with Corsair to date and any potential links to Birkenstein are not presently clear.

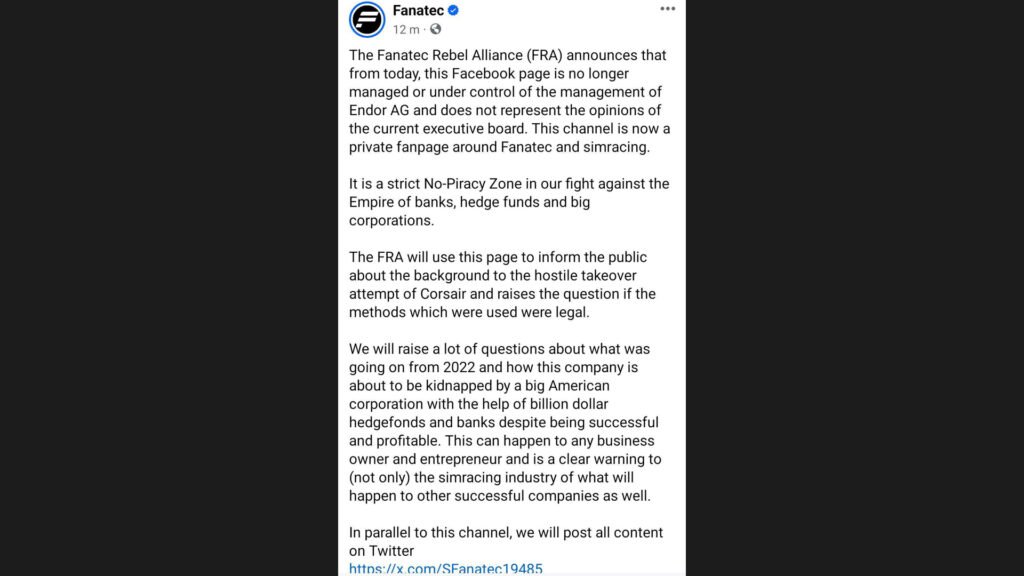

Earlier this week (29th May), it appears the Bavarian sim racing equipment manufacturer’s Facebook page was taken over – albeit briefly before deletion – in an suspected last-gasp attempt to prevent a possible sale by the “Fanatec Rebel Alliance”.

“We will raise a lot of questions about what was going on from 2022 and how this company is about to be kidnapped by a big American corporation with the help of billion dollar hedgefonds (sic) and banks despite being successful and profitable,” read part of the ephemeral post.

Corsair “will fully take over” Fanatec

Meanwhile, in the press release addressing the Q1 2024 financial results, Endor remains indefatigable in its assertions that a potential Corsair deal is on the horizon.

“As part of this restructuring, an investor has been found in Corsair who will fully take over Endor and provide sufficient financial resources to stabilize the Company without external debt,” it said.

This is the most strongly worded affirmation yet during this contentious battle for power.

Chat with the Community

Sign Up To CommentIt's completely Free